The Master Plan serves as a basis for power development in Vietnam. All investment in the power sector must comply with the Master Plan. The most recent Master Plan is the Revised Master Plan VII from 18 March 2016 which adjusted the Master Plan for the period of 2011-2020 with a vision to 2030 (“Master Plan VII Revised”). The new Master Plan is now due and on 22 February, the Ministry of Trade and Industry (“MOIT”) issued a draft National Power Development Plan for the period 2021-2030, with a vision to 2045 (“Draft Master Plan VIII”) in order to collect opinions from relevant government ministries and agencies.

“It appears that MOIT intends that all projects will be awarded under a competitive bidding process.”

Draft Master Plan VIII provides more detail on the award of energy projects in Vietnam and the planned total capacity through to 2045. Renewable energy features strongly in the planned capacity, and we have set out below some key points to note.

Project Award

Vietnam’s Law on Investments¹ that came into force on 1 January 2021 provided the possibility for new projects to be awarded to sponsors by a competitive bidding process, rather than direct award. The requirements for this process were not fully provided in the Law on Investments, and some further details are provided in Draft Master Plan VIII:

- It appears that MOIT intends that all projects will be awarded under a competitive bidding process;

- MOIT suggests preparing short-to-medium term plans annually or every other year, which would set out the plans for developing power sources and the grid in that period. These plans would be used as a basis for bidding;

- MOIT suggests the development of bidding authorities, that will be responsible for running the bidding process;

- It is suggested that there will be three different types of bidding: (i) project-based bidding for large scale projects; (ii) public bidding for wind and solar projects, the scale of which will be proposed by regional authorities; and (iii) substation-based bidding. We await further details of these proposals; and

- The new proposals do not apply to any project that has already been awarded or where the investor is named in the Master Plan.

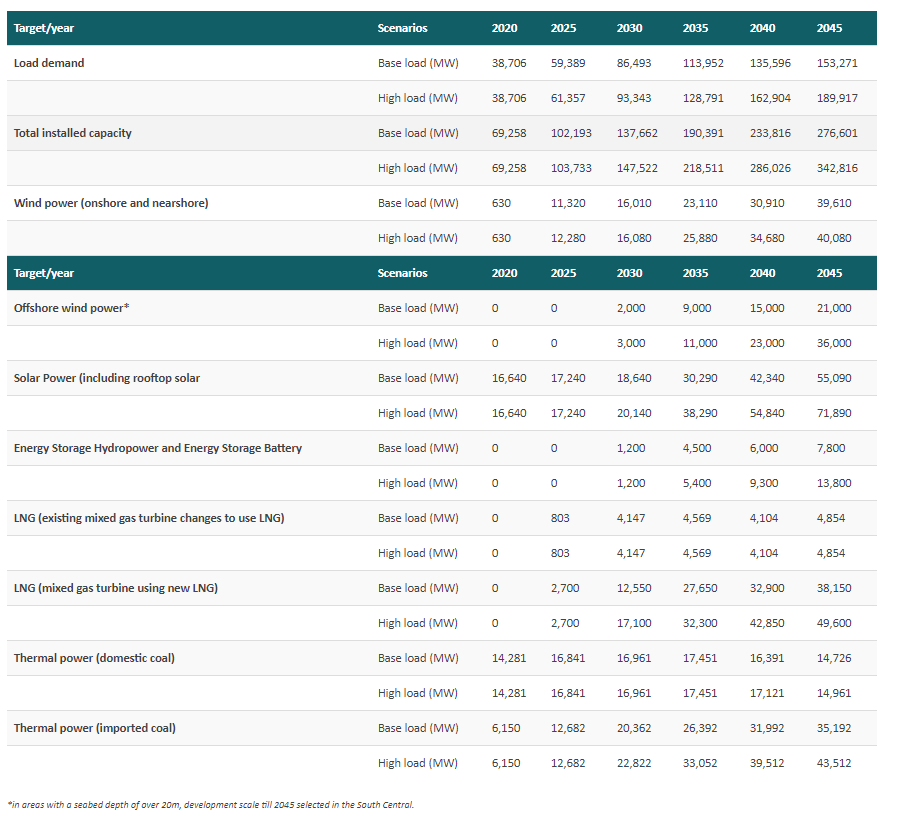

Potential scenarios for power development in Vietnam

The Draft Master Plan VIII sets out various potential scenarios for power development in Vietnam which take into account potential fluctuations such as in load forecasts, investment costs and the weather. We set these out in the table below. For comparison, the table also shows projections for coal and LNG-fired power plants in addition to renewables.

“As shown in the table (which only covers the key south-central region), Vietnam is expecting a significant increase in offshore wind power.”

OFFSHORE WIND

Draft Master Plan VIII identifies a total technical capacity² for offshore wind at around 162 GW (studied by Denmark Energy Agency) of which approximately 80 GW are located in areas with a high wind speed (over 7-9 m/s) and are considered economically viable.

It is worth noting that offshore is classified as areas with a sea bed depth over 20m – previously Vietnam has not differentiated between offshore and near-offshore.

As shown in the table above (which only covers the key south-central region), Vietnam is expecting a significant increase in offshore wind power. In comparison, in Master Plan VII Revised the total capacity of wind power was planned to reach 2,000 MW in 2025 and 6,000 MW in 2030.

A number of challenges remain for the development of offshore wind in Vietnam. These include, in particular, bankability issues for the Power Purchase Agreement (“PPA”). The PPA for all renewable projects will be based on the standard Vietnamese law template published by MOIT and Vietnam Electricity (“EVN”). Potential foreign investors and lenders have previously identified a number of concerns with the template document, including curtailment and termination payments. We understand various developers are attempting to negotiate upgrades to the PPA with the Vietnamese government. This will be a key area to watch in 2021.

The second key uncertainty relates to the Feed-in Tariff (“FiT”) for wind (8.5c/kWh onshore and 9.8c/kWh offshore) which expires in November 2021. We are aware that a proposal has been circulated by MOIT to extend the FiT, reducing on a sliding scale through to 2024. However, it is unclear whether this will be adopted. It is worth noting in this context that in the last year EVN had a surplus of electricity due in part to the large uptake in solar in 2020 (see below). As a result, there may be a reluctance to offer a blanket extension of the FiT, although it may be possible to negotiate a FiT on a bilateral basis. Finally, we note that EVN may be likely to agree bankability changes to the PPA if the tariff is favourable to them.

SOLAR

As at 31 December 2020, the total capacity of grid-connected solar in Vietnam in operation is around 9 GW (including 7780 MW of rooftop solar) and the total approved capacity is around 13 GW – far exceeding the total expected capacity of 850 MW for 2020 in Master Plan VII revised. About 50 GW of solar power has been registered for construction and is yet to be approved for inclusion into the Mater Plan.

The FiT for solar expired at the end of 2020. There are reports of a reduced FiT for rooftop solar to be announced later this year, however we understand that there will be no extension of the FiT for ground-mounted solar and new ground-mounted projects will be expected to compete in a competitive auction system.

A draft decision on selection of investors for the development of solar power projects³ has been proposed by the Electricity and Renewable Energy Authority (“EREA”) for MOIT’s internal approval. According to the proposal, investor selection shall be conducted by either of the following methods: (i) bidding for selection of investors based on the project location; or (ii) investor approval (this will generally apply if there is only one bidder or the auction fails). According to the proposals, each bidder will submit two envelopes – (1) a technical proposal and (2) a financial proposal. Among the investors satisfying the eligibility and technical requirements, the one proposing the lowest tariff not exceeding the ceiling price (to be determined by MOIT for each year) will be selected.

It should be noted that the bidding does not guarantee that the land will be cleared and the developer will still be required to factor in costs and timing of land clearance in their proposal for bidding (which can be costly, uncertain and time consuming).

LAW ON RENEWABLE ENERGY

MOIT has suggested a new law on renewable energy to implement Master Plan VIII. We believe that the certainty that this would provide would be welcomed by all participants, but note that such a law would take time to implement.

DIRECT POWER PURCHASE AGREEMENT

The Vietnamese government has previously announced a pilot programme for corporate PPAs in Vietnam. Although there are no new details of the Direct Power Purchase Agreement (“DPPA”) pilot program in Draft Master Plan VIII, the principals are referred to and we understand that MOIT and EVN remain committed to DPPA. As a brief summary, the principals of the DPPA are:

“Grid improvement is a major issue in Vietnam and both MOIT and EVN are aware. It is one of the biggest issues for curtailment risks.”

- Total capacity of up to 1000 MW for the pilot programme;

- Both wind and solar are eligible;

- Both the developer and the corporate purchaser will enter a standard for PPA with EVN to sell and purchase electricity at the wholesale rate;

- Developer and purchaser will also enter into a contract for difference to pay each other the difference between the wholesale rate and an agreed strike price; and

- The developer will benefit from a priority dispatch obligation from EVN which will help reduce the curtailment risk. However, due to using the standard PPA, there are still a number of risk allocation issues that will need to be agreed between the developer and the corporate purchaser.

We expect full details of the scheme to be published by the second quarter of 2021.

GRID AND BATTERIES

The Draft Master Plan VIII notes that grid systems will need to be developed, and suggests a focus on smart grid development and use of 4.0 technology to manage supply and demand. Grid improvement is a major issue in Vietnam and both MOIT and EVN are aware. It is one of the biggest issues for curtailment risks. Ultimately, grid investment will depend upon financing.

In Draft Master Plan VIII MOIT proposes the preparation of a mechanism encouraging the development of flexible power sources including battery storage for flexible operation. Installation of battery storage together with smart grids are considered as solution for integrating renewable energy into the power system and is proposed to be implemented after 2030.

Source: https://www.lexology.com/library/detail.aspx?g=b9922797-ef96-48ca-b103-f9d1706e9a58