Some new major changes of Circular No. 01/2021/TT-BKHDT dated March 16th, 2021 of the Minister of Planning and Investment providing guidance on enterprise registration.

On March 16th, 2021, the Minister of Planning and Investment promulgated the Circular No. 01/2021 TT-BKHĐT providing guidance on enterprise registration. The Circular No. 01/2021/TT-BKHDT took effect from May 01st, 2021 and superseded the Circular No. 20/2015/TT-BKHDT dated December 01st, 2015 and the Circular No. 02/2019/TT-BKHDT dated January 08th, 2019 by the Minister of Planning and Investment. The forms used for registration of enterprises and household business in the Appendix enclosed with the Circular No. 01/2021/TT-BKHDT shall be uniformly used nationwide from the effective date of the Circular.

There are several new points of the Circular No. 01/2021/TT-BKHDT (hereinafter referred to as Circular 01) as follows:

1. Content of the Circular

Circular 01/2021/TT-BKHDT includes 07 articles. It is clearly stipulated in the Article 1 that the scope of the Circular’s forms is uniformly nationwide; and the subjects of the Circular are those participating in the enterprise registration pursuant to Article 2 of the Decree No. 01/2021/ND-CP dated January 4th, 2021 of the Government on enterprise registration.

Besides, the Circular also provides guidance on digitalization – storage of application dossiers and reconciliation of business registration data in the National Business Registration Database.

2. Forms enclosed with the Circular

Circular 01 has annulled 06 forms of Circular No. 02/2019/TT-BKHDT related to: the company seal announcement, offering private of shares and the list of members in the establishment of household businesses; adding on 19 new forms; amendment several forms and adding notes guiding the declaration in forms to be complied with the provisions of the Law on Enterprise 2020, Decree No. 01/2021/ND-CP and facilitate the implementation of business registration procedures.

Notable changes in Forms enclosed with Circular 01 are as follows:

2.1. Forms for enterprises/household businesses

a. Form for enterprises

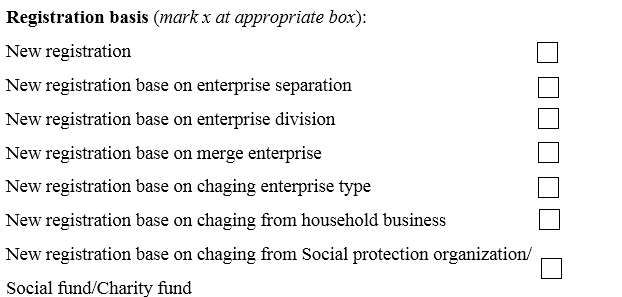

– Adding the case of establishing new base on converted from a social protection establishment/social fund/charitable fund under the Decree No. 01/2021/ND-CP. Enterprises shall mark up and declare information about the social protection establishment/social fund/charitable fund if they are in this case.

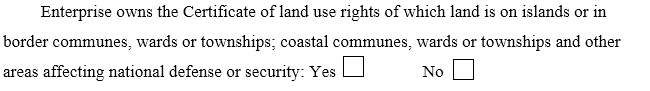

– Adding a tick box of Certificate of land use rights of which land is on islands or in border communes, wards or townships; coastal communes, wards or townships and other areas affecting national defense or security in case a foreign investor would make capital contribution, buy shares or capital contributions to an enterprise, which leads to an amendment in business registration.

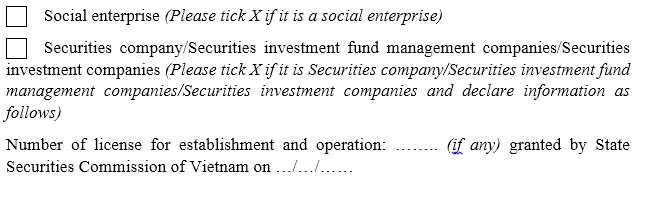

– Adding a tick box regarding/of social enterprises and securities companies.

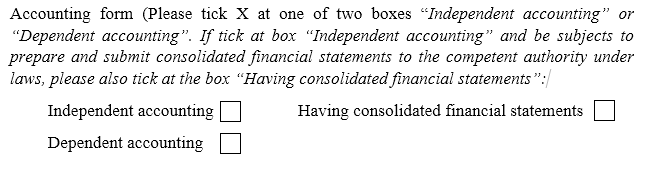

– Accounting form (tax information block): Adding a tick box “Having consolidated financial statements” in case an enterprise is requested to prepare and submit consolidated financial statements to the competent authority under the law on tax administration.

– Annulling the information field of bank account in accordance with the law on tax administration. Enterprises are not required to declare this section when register for establishment or to notify the Business Registration Office of any change in bank account information.

– Annulling the information field of bank account in accordance with the law on tax administration. Enterprises are not required to declare this section when register for establishment or to notify the Business Registration Office of any change in bank account information.

– Annulling the “Notification of enterprise’s executive replacement” section and annulling the tax accounting method under tax information block of Notification of changes to enterprise registration Form to be complied with the Law on Enterprises 2020 and regulations on tax administration.

– Annulling Forms as follows: Announcement of private placement of shares; Announcement of using/replacement/un-registration of enterprises and affiliates’ seals since the Law on Enterprise 2020 no longer regulates these procedures.

– Adding Forms as follows: Application for supplement and update of business registration information for securities companies and their affiliates, branches in Vietnam of foreign securities companies/foreign fund management companies; Announcement of invalidate the resolution or decision on enterprise dissolution; A request form to stop procedures for enterprise registration.

– Adding 03 forms of social enterprise’s commitment: commitment to fulfill social/environmental objectives; Notice of changes in commitment and Notice of termination of commitment.

b. Forms for household businesses

Forms for business households are amended to be in line with new regulations on business households of Decree No. 01/2021/ND-CP:

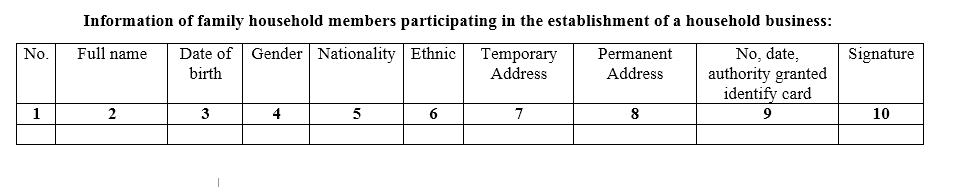

– Declaring family household members participating in the establishment of a household business in the Application Form for household business registration and annulling the list of individuals contributing capitals to establish a household business as the Decree No. 01/2021/ND-CP stipulates that subjects of household business registration are individuals and family household members, excluding groups of individuals.

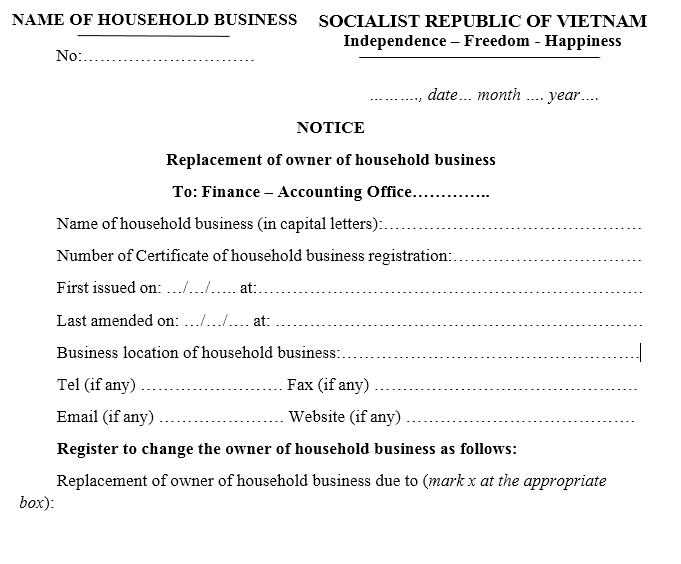

– Adding replacement form of the owner of the household business.

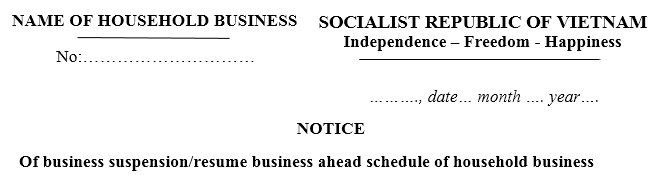

– Adding the case of a household business resumes its business ahead of schedule in Notice of household business’s suspension form.

2.2. Forms used by individuals and organizations

Circular 01/2021 TT-BKHĐT adds 02 forms used by individuals and organizations if they desire to be provided with business registration information or to request for revocation of business registration certificate, which are:

– Request for provision of business registration information;

– Request for revocation of business registration certificate.

Above are some new major changes/highlights of Circular No. 01/2021/TT-BKHDT. Difficulties that arise during the implementation of this Circular should be promptly reported to the Ministry of Planning and Investment for consideration.

Source: Dangkykinhdoanh